Amortization of Patent Cash Flow

However because amortization is a non-cash expense its not included in a companys cash flow statement or in some profit metrics. As another example ABC has been amortizing the acquired cost of a patent for several years.

Amortization Of Intangible Assets Formula And Calculator Excel Template

An acronym standing for Earnings Before Interest Taxes Depreciation and Amortization EBITDA is a commonly used measure of a companys ability to generate cash flowTo get EBITDA you would add net profit interest taxes depreciation and amortization together.

. All in theres little to suggest the dividend is at risk here especially when you note the companys fairly modest 65 distributable cash flow. If they determine the value of the patent is ten years then the. Free cash flow was 167 million compared with a use of 13 million in the second quarter of 2021.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Since the free cash flow of the firm states the business. This is where a Cash Flow Forecast formula comes in.

Patent capitalized cost 250000 180000. In lending amortization is the distribution of loan repayments into multiple cash flow instalments as determined by an amortization scheduleUnlike other repayment models each repayment installment consists of both principal and interest and sometimes fees if they are not paid at origination or closingAmortization is chiefly used in loan repayments a. D predicts future cash flows Highly liquid short.

Second quarter Adjusted EBITDA of 1758 million. In the words of WCF. Completed Montana Renewables financing highlighting a 225 billion.

Equity often called shareholders equity or owners equity on a balance. There has been a lot of ink spilled on the benefits or harm done by considering depreciation and amortization a non-cash expense. The acronym EBITDA stands for earnings before interest taxes depreciation and amortization.

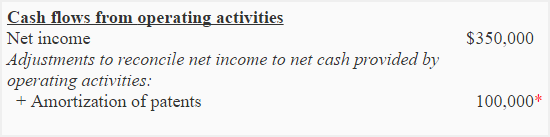

Amortization Expense is just like depreciation but for the intangible Lets say that a company has built a patent by expending around 100000. It also refers to the spreading out. Cash Management Impact of Inflation on Cash Flow.

A determines the ability of the company to pay dividends and interest. Your cash flow forecast helps you determine what your cash position will be in the next month three months year and so on. Net loss of 153 million or 019 per unit for the second quarter 2022.

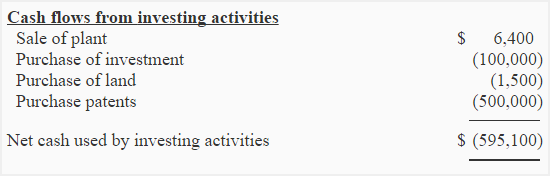

Cash flow from investing activities means any cash earned or lost on activities like buying or selling an assetsay a piece of property or equipment. For years ending 2019 2020 2021 from the companys annual report. Having a clear cash flow forecast ensures that you know what your cash runway is how much time until you hit 0 as well as the difference between profits and your actual cash position.

The 75000 that has been charged to expense thus far over the life of the intangible asset is its amortized cost. Study with Quizlet and memorize flashcards containing terms like A statement of cash flows accomplishes all of the following EXCEPT. Now if it lasts for ten years then the company has to record the amortization expense of 10000 each year as an amortization expense.

Money from assets like equipment or long-term investments. The improvement was driven by lower working capital requirements largely attributable to focused. Cash Flow Forecast is one of the easiest formulas to calculate.

B provides information about the cash receipts and cash payments during a period. ABZ successfully defended the patent but incurred legal fees of 50000. Unlike operating activities which include daily short-term gains and expenses investing activities are all about the long term.

Hartley advance terms it comes dangerously close to. To accomplish this you can either. C lists revenues and expenses.

You cannot use them to plan for the future. EBITDA is a useful metric for understanding a businesss ability to generate cash flow for its owners. Below is an example of the cash flow statement for Tesla Inc.

Some consider these items as non-cash because we add them back to earnings to calculate free cash flow where others consider it an expense. Inflation is growth in value terms and therefore in periods of rapid inflation a firm should expect to find itself in a very unfavourable cash flow position like that of the firm which is growing very fast. While both Free Cash Flow FCF and Operating Cash Flow OCF methodologies provide insights into cash flow of your business in a given period.

Capital expenditures are shown as negative numbers under. A more rapid rate of amortization depreciation or depletion will result in a higher amortized cost which means that it is less.

Patent Cost In Financial Projections Plan Projections

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

Amortization Of Intangible Assets Formula And Calculator Excel Template

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

No comments for "Amortization of Patent Cash Flow"

Post a Comment